Finlex at the Innovario in Bonn

The year is coming to an end but an important industry event is still to come: InnoVario. The 8th InnoVario will take place on 15 and 16 November 2022 at the Rhein Sieg Forum in Siegburg/Bonn. This year, there will also be the option of attending virtually.

The annual industry event is all about promoting dialogue on innovative business models, new product concepts, process optimisation and future developments in the insurance industry.

The focus of the 8th InnoVario is on the “drivers of change”. The first day will focus primarily on technological and social change. On the one hand, a glimpse will be taken at the advancing digitalisation, the increase in data and the use of artificial intelligence. At the same time, social change will be discussed, which is based, among other things, on changed value concepts, an increasing awareness of sustainability and new work concepts. The second day of the event will deal with the resulting changes in the market environment as well as the changes in the risk landscape.

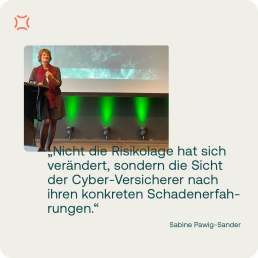

We are very pleased to have Sabine Pawig-Sander, Non-Executive Director, join us on the 2nd day of the conference with a presentation. “It is not the risk situation that has changed, but the Cyber Insurers’ view of cyber_risk according to their concrete claims experience,” she said in her presentation on “Cyber Risks: the seven-headed hydra of the digital world”. Similar to the monster Hydra, it is allegedly the case with the insidious Cyber Risks that companies and insurers are fighting against. No sooner has one risk been eliminated than two new ones appear. The risk landscape in the Cyber Sector is changing due to ever better malware, that is true. But mainly, the loss experiences of companies and insurers have sharpened the focus on the technical details – this leads to better awareness among companies and more qualified IT security requirements in the insurers’ risk assessment. In order to be protected in the best possible way, it is necessary to increase risk awareness among companies and to strengthen technical protection against attacks.

Similar Posts

Crowdstrike-Vorfall – Erhalten betroffene Unternehmen eine Entschädigung aus ihrer Cyber-Versicherung?

Ein fehlerhaftes Update des US-amerikanischen IT- Sicherheitsdienstleisters Crowdstrike hat am Freitag zu weitreichenden Störungen geführt. Experten sprechen vom größten, nicht…

Weshalb ein stabiler D&O-Markt unwahrscheinlich ist

In den letzten Jahren wurde die deutsche Wirtschaft durch die Covid-19 Pandemie, geopolitische Krisen sowie hohe Inflation geprägt. Sowohl wirtschaftliche…

Berkley Deutschland – einer der führenden Anbieter von Spezialversicherungen und Risikolösungen für den Mittelstand mit umfassendem Produktangebot in Deutschland und Österreich

Im Interview sprechen Alexa von Brevern, Manager Financial Lines und Manuel Metz, Manager Cyber Europe darüber, warum Versicherungsschutz insbesondere für…

Finlex Financial Lines Summit Austria 2024

[vc_column width="1/1"]This was our 1st Financial Lines Summit Austria - the industry meeting of the rapidly growing cyber and financial…

New Cyber Expert Lane on the Finlex platform with innovative tender feature

Specialist broker Finlex is launching its new Cyber Expert Lane for companies of all sizes and in all sectors. The…

Smarter D&O-Versicherungsschutz auch für große Kanzleien

Erweitertes Angebot der Zurich Gemeinsam mit den Versicherern Markel, ERGO, Newline und Zurich bietet Finlex eine spezielle Unternehmens-D&O-Versicherung für Kanzleien…

The requirements of § 81 para. 2 VVG (grossly negligent causation of the insurance case) in Cyber insurance

[vc_column width="1/1"] (Erichsen/Seiz, r+s 2024, S. 97) Unfortunately, Cyber attacks on businesses are no longer uncommon, but rather part of…

Impact of the current ECJ jurisdiction on Art. 82 GDPR on Cyber insurance

In three recent judgments (C-687/21, C-340/21 and C-456/22), the ECJ has clarified its jurisdiction on the data protection responsibility of…

Personal D&O insurance on Finlex platform with three insurers

Managers now can protect themselves against liability risks targeting their personal assets. They can purchase a personal D&O insurance via…

Finlex expands its Cyber Ecosystem

To counteract the developments in Cyber crime, Cyber insurance is continuously changing and improving. Companies, however, need a symbiosis of…